- A gratuity of up to Rs.20 Lakh paid by organisations covered under the Payment of Gratuity Act, 1972, other than central and state government departments, defence, and local governing bodies, is exempt from tax as per the gratuity rules 2020.

- The Payment Of Gratuity Rules. Vacation Request Letter. Sample Letter Of Recommendation For Athletic Director Position. This is an simple example of a sample appointment letter. Your company or HR executive can make modifications as per your company policy or situation. October 14, 2013 (Name) (Company) (Employee Number) Dear Mr.

- Sample 1 – Waiver Letter To Request Obligation Be Waived. Address of Sender. City, State, Zip Code. RE: Bank or Loan Account Number. To Whom It May Concern: This letter is a formal request to have my monthly payments of $150 on my car loan frozen for six months from DATE to DATE.

- Request Letter Format For Gratuity Rules 2019

- Request Letter Format For Gratuity Rules 2020

- Request Letter Format For Gratuity Rules Pdf

For payment of cheque semioffice com, sample letter for request sample letters, loan against gratuity english forums, free legal letters rocket lawyer, request letter format for gratuity rules in pakistan, hr order doj1200 1 part 6 workers compensation program, i need a sample letter of gratuity payment i need a, i want to. Sample for an employer to augment his employee to another office or department gratuity request letter to company sample complaint letter to employer against manager of harrassment a sample letter to request employer to pay me money via the bank instead of cash sample of application for the claim of gratuity to the company, when claims for payment.

From India, BangaloreIf You have documents to prove that you had worked for 7 years continuously, then no one can deny the gratuity money.

First you write a letter along with Form I to the HR and the Management stating about the claim of Gratuity for the period you have served.

Wait sometime for a reply. If they are not responding, take this matter to the Asst/Dy Labour Commissioner for your area with a request letter with form N for gratuity settlement. He will do the needful.

S.Sethupathy,

Excellent HR Services,

Erode.

From India, Selam

Request Letter Format For Gratuity Rules 2019

| FORM I pg act.doc (20.5 KB, 1267 views) |

| FORM N.doc (31.0 KB, 800 views) |

With regards to gratuity, I have one query. I am working in a software company since Dec.2004. In Sept.2005 I had taken one month break. Again joined after one month. Till date I am working in same company. If I resign from this company, will I be able for gratuity? If yes, how much years of service will be considered?

Thanks & Regards,

Suvarna

From India, Pune

For the year 2005 what you have done reigned and rejoined?

If it is rejoined the calculation will be taken from that day onwards.

Please note that even one can out of duty /LOP etc., the 240 days rules applicable to consider that year as a part of continuous services.

S.Sethupathy,

Excellent HR Services,

Erode.

From India, Selam

I joined company on 2 May 2005 as trainee on stipend (no Epf deduction) as an employee with appointment letter and got confirmed exactly after 1 year i.e. 2May 2006 (EPF deductions begin)and left it on 23rd Feb 2011. Do I stand eligible for gratuity?? And from where can I cite the clarity to company HR as they too are not sure, as 5 years are not completed.

Thanks in advance

Regards

Ajitsingh

From India, Madras

EPF deduction has no role in Gratuity calculation.

Your date of joining is the base for the calculation.

Hence you are eligible for gratuity.

Gratuity calculation = Your last drawn basic+DA X 6 years of service X 15/26.

S.Sethupathy,

Excellent HR Services,

Erode.

From India, Selam

My case also similar to Mr.redstain.I have worked for seven years in Software company(First Job). i resigned and properly relieved on Feb2011 when i was asked about my gratuity settlement, HR told gratuity was given long with my salary, but i didnt see any such component in payslip breakup. when i started explaining more about gratuity he told we didnt mention gratuity in offer letter so we wont provide gratutiy and he behaved very rudely. when i escalated this issue to manger he too replied the same and also told even if u do legally to claim gratuity we knew how to handle.

I dont know what to do.. with similar exp around 6 person left the company without getting Gratuity settlement (by fearing they will give bad remark in background verification). we are even ready to take legal action now.

so if we approach Asst/Dy Labour Commissioner will we get back our gratuity money

Note:

1. we all joined this company thru CAMPUS interview and served without break for 7 years.

- In our Offer letter, thr is no gratuity mentioned(Is this mandatory to mention in offer letter to claim Gratuity settlement)

- is thr any time frame, to ask for gratuity settlement after relieved date.

Please help us

Ram

From India, Madras

Many companies are not mentioned anything about gratuity in their Appt orders, which doesn't mean that they can deny it.

Suppose a company not mentioned anything about PF/ESI in their Appointment Orders, should they explain the same to the PF or ESI authorities for non deduction?

Please go through the Section 1 of this Act-

Section: 1

Short title, extent, application and commencement.

(1) This Act may be called the Payment of Grataity Act, 1972.

(2) It extends to the whole of India:

Provided that in so far as it relates to plantations or ports, it shall not extend to the State of Jammu and Kashmir.

(3) It shall apply to¬ -

(a) every factory, mine, oilfield, plantation, port and railway company;

(b) every shop or establishment within the meaning of any law for the time being in force in relation to shops and establishments in a State, in which ten or more persons are employed, or were employed, on any day of the preceding twelve months;

for your reference I am enclosing the bare act of it. Please go through this.

Also note that if the company functioning more than one state then the Central Rules are applicable.

All the best Ram

S.Sethupathy,

Excellent HR Services,

Erode.

From India, Selam

| Payment of Gratuity Amendment Act 2009.doc (21.5 KB, 472 views) |

| Payment of Gratuity Amendment Bill 2010.pdf (78.6 KB, 564 views) |

| PaymentofGratuityAct.doc (86.0 KB, 786 views) |

| Payment of Gratuity Central Rules 1972.doc (206.5 KB, 571 views) |

You are eligible for gratuity and is not part of salary structure. will be payable after continuous service of 5 years. ('superannuation', in relation to an employee, means the attainment by the employee of such age as is fixed in the contract or conditions of service at the age on the attainment of which the employee shall vacate the employment; )

Mr S.Sethupathy has given right guidelines please follow and also request to Asst Labour commissioner for this.

From India

Please furnish the following information so as to answer your query.

1.What was the designation given to you at the time of initial appointment?

2.Subsequently was there any change in the designation given to you? If so please indicate the change and the date from which the change took place.

3.What was the nature of work done by you. Did it continue to be the same from the time of initial appointment until you left the company.

4.Where this company is situated?

5. Does it have branches in more than one State?

From India, Madras

If you are knowledgeable about any fact, resource or experience related to this topic - please add your views using the reply box below. For articles and copyrighted material please only cite the original source link. Each contribution will make this page a resource useful for everyone.

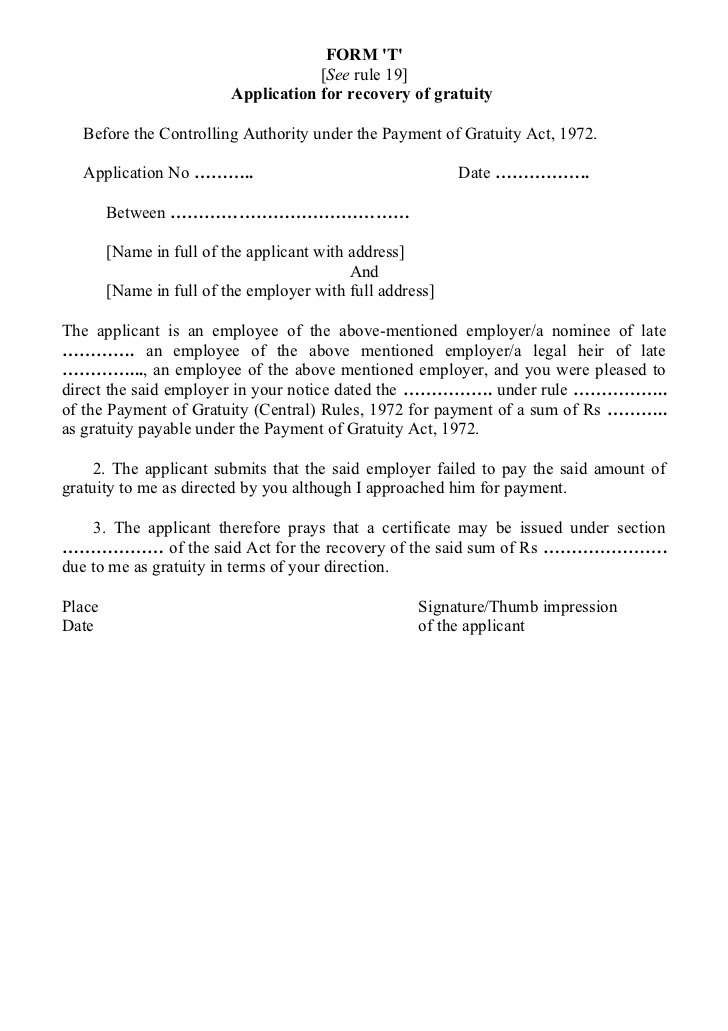

Payment of Gratuity Format Letter

For claiming gratuity form I is used and for sanctioning the same form L is used. Please find the attached forms.

FORM ‘I’

[See sub-rule (1) of rule 7]

Application of gratuity by an employee

To ………………………………………………………………………………………………………….

[Give here name or description of the establishment with full address]

Sir/Gentlemen,

I beg to apply for payment of gratuity to which I am entitled under sub-section (1) of section 4 of the Payment of Gratuity Act, 1972 on account of my superannuation/retirement/resignation after completion of not less than five years of continuous service/ total disablement due to accident/ total disablement due to disease with effect from the …………… Necessary particulars relating to my appointment in the establishment are given in the statement below:

Statement

1. Name in full.

2. Address in full

3. Department/Branch/Section where last employed.

4. Post held with Ticket No. or Serial No., if any.

5. Date of appointment.

6. Date cause of termination of service.

7. Total period of service.

8. Amount of wages last claimed.

9. Amount of gratuity claimed.

I was rendered totally disabled as a result of

[Here give Detail of the nature of disease or accident]

Payment may please be made in cash/open or crossed bank Cheque.

As the amount of gratuity payable is less than Rupees one thousand, I shall request you to arrange for payment of the sum to me by Postal Money Order at the address mentioned above after deducting postal money order commission therefrom.

Yours faithfully,

Place Signature/Thumb impression of

Date the applicant employee.

Note:

1. Strike out words not applicable.

2. Strike out paragraph or paragraph not applicable.

Request Letter Format For Gratuity Rules 2020

Other Related Claim Letter Formats

Claim Letter Example

Employee Death Claim Letter

PF Death Claim Forms

Format for Liens and Claim release Certificate

Search Sample Formats:

Request Letter Format For Gratuity Rules Pdf

Related Sample Formats: